Geopolitical Events and Forex

Recently, the threats exchanged between America and North Korea have had a significant effect on the markets in general. The markets have been affected by the uncertainty that results from any potential threats of war. This uncertainty has led to a flight to what is called safety or safe assets. Safe assets include gold, silver, the Swiss franc, and the Japanese yen. Money pours into these assets because they’re considered the most stable among all the currencies. Geopolitical events and forex mean any events worldwide that have to do with a threat of or actual war, extreme weather events, earthquakes, political events, elections (especially surprise ones), the toppling of governments, hyperinflation, splits from international agreements, and any catastrophe natural, or otherwise that can affect a currency.

Flight to Safety

In the above example, the contentious atmosphere has lead to a flight to safety and lessening for the demand of US dollars; this is despite the US dollar usually being considered an alternative safe haven. However, things have changed, and the US currency moved down with respect to other currencies. I use such information when deciding on a currency pair to trade for a recent shorter-term trade.

News Sources

Any potential threat of war leads to uncertainty as to which direction things are headed economically and therefore an outflow of investments. Such information can be gleaned from regular or business news sites such as Bloomberg or Reuters as well as newsfeed services such as Ransquawk. It’s important to stay in touch with worldwide events so one can react quickly to the news after it’s announced. The time that geopolitical events can have their effect can last anywhere from hours to weeks or months. The seriousness determines the duration of the impact and whether the geopolitical event itself has died down or is ongoing.

Natural Disasters

Geopolitical events and forex are tied together in the form of natural disasters as well. Japan’s 2011 9.0 earthquake and subsequent tsunami had a devastating impact on the nearby Fukushima nuclear power plant. This event led to a flow of capital into the Yen as shown below. Although the Yen is a flight to safety currency, as mentioned above, the real reason in this case for the buying up of Yen was the expectation for the demand for Yen to pay for the rebuilding of Japan’s infrastructure.

Elections

The election of President Emmanuel Macron in the French elections of 2017 was expected by the markets. This expectation became priced in earlier on before the official win on May 7, 2107. The polls showed the election skewed in his favor to the extent that it was almost a sure win. This resulted in the euro moving up as a Macron win was generally considered better for the French and therefore European economy as a whole. After the election, the euro, as seen below, dipped and then climbed to its highest price in half a year, it broke above $1.10 for the first time since the U.S. election in November of 2016.

Split from Unions

Brexit is another example of a political event that had huge implications for the pound. On June 23, 2016, the people of Great Britain voted to leave the European Union by a majority vote of 51.9%. This caused a massive drop in the pound against all major currencies. As seen below, the pound dropped for days against the USD as Brexit was seen as having an overall negative effect on the British economy. The vote for leaving came as a complete surprise for the market as most analysts predicted a definite "no" vote, considering the negative effects associated with a "yes to leave" vote. Again, geopolitical events and forex moves go hand in hand as witnessed below:

More Examples

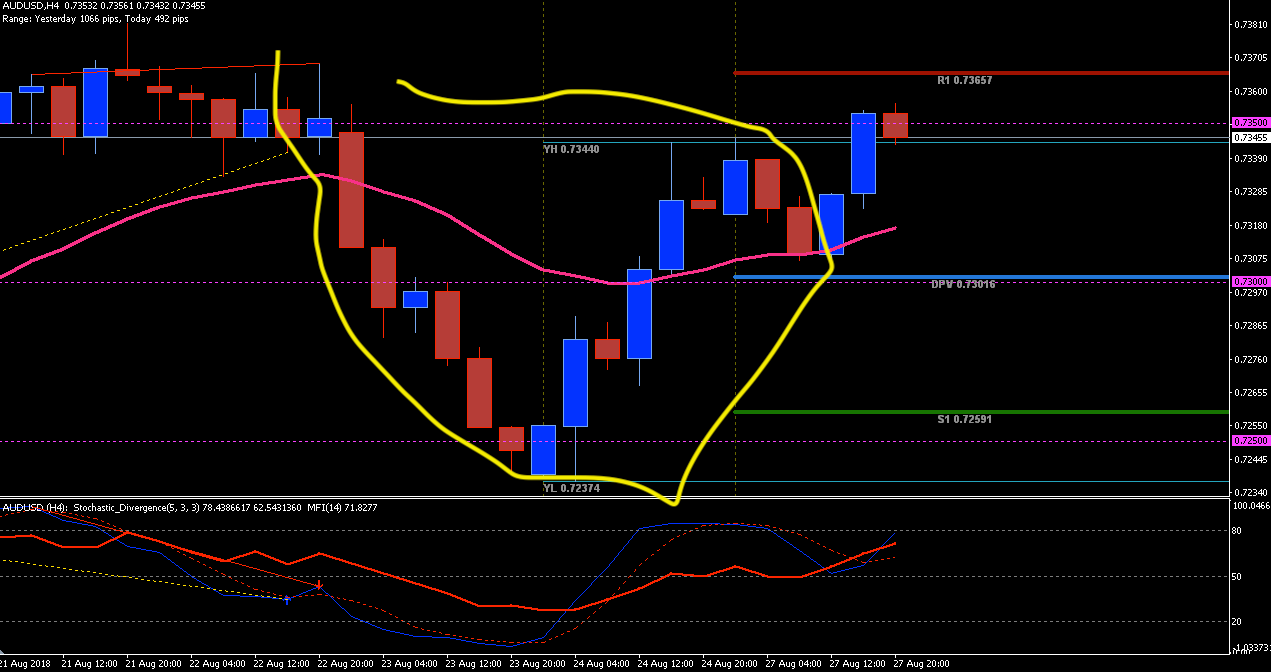

Political Event Effecting Forex Prices

The latest example occured on August 22nd 2018. We see below that the AUDUSD took a quick dip. The dip was due the news that there was a leadership vote for the sitting Australina prime minister . You can see here that the AudUsd took a quick dip down close to recent support. Although a minor disturbance, you can see the advantage of keeping in cise contact with the news. This drop fell over 80 pips.

Another Political Event Effecting Forex Prices

News came out on Aug 27th 2018 that the NAFTA deal between the US and Mexico was almost finalized . This provided Canada with some hope that it will complete its deal and so the CAD increase in value with restpect to the USD. This caused a fall in the USDCAD pair as seen below:

Please Share this article and Join Our Subscription below to get our

Free Trading Strategies Using Price Action Patterns PDF !

How Global Events Affect The Forex Market

There is no question that political events in our world affect the worlds economies.

It affects Forex as well as Wall street.

My concern is if the U.S. currency fails. If we do not have some silver or gold

how are we going to purchase things?

I have heard that Forex can be very volatile, and should only be used as perhaps ten percent of your portfolio

What do you think?

Forex news concerning political events such as the U.S. elections is a big mover of currency pairs. It leads to predictable movements that can be traded. This sort of trading is separate from a more conservative stock portfolio. I don’t think the US dollar will fail, it’s just going to be more diluted with time. Preserve your wealth with a percentage of your worth in gold.

Many thanks for this thorough review on the influence of geopolitical events on the various currencies. I wonder if you could mention terrorist attacks in your article. What do you think? Moreover, currently, in France there are huge strikes all over the country against the pension reform. This could also have some sort of influence. What is your view on this?

I will try to include some comments on terrorism and its effect in the future. I don’t the pension strikes are viewed as a large enough destabilizing factor by the markets to be one of the factors affecting foreign exchange rates.

Thank you for this post.

It’s amazing at how volatile currencies are, or may I should say fragile. Natural disasters, man made disasters, the uncertainty of war and do on, all seem to influence values. It’s quite interesting to see how value fluctuates in various scenarios.

I think it will take me some time to notice the nuances and anticipate the fluctuations in the related currencies.

Was there any fluctuation due to the recent volcano eruption in New Zeland?

Thanks again,

Scott

Earthquakes in the past, when they inflict serious damage, have influenced currency prices. Natural disasters, political events, wars and even trade wars such as the US-China trade war affect currency prices.

I don’t think the recent volcano eruption in New Zealand had a big enough impact to influence the price of the New Zealand dollar.

For regular events that influence currency price, refer to an economic forex calendar such as this one:

https://www.forexfactory.com/calendar.php

When I initially read the word Forex I thought it was a typo for “forests”. hahaha.

Well, I learned a new word today. Never knew that political discrepancies resulted in the decline of the U.S currency.

Wow, there are so many factors that go into the stability of the world. Even the weather makes a difference. How can I possibly keep up with it all?

Thanks for the information.

You need to narrow your focus on which currencies you follow. I follow news related to what are called the major currencies: USD, JPY, CAD, EUR, AUD, NZD. That should provide you with enough trades.

Very interesting post. After reading it, I was left wondering how any country’s currency can be seen as safe. There are always threats of war, natural disasters, and political upheaval. Who decides (or is it an effect of some other mechanism) and what criteria is used to make this determination? I appreciate the time you took putting together such an illustrative piece.

In general, the US dollar is considered the safest currency as it’s backed up by the U.S. government and economy. The U.S. economy is the most stable among all global economies today. It’s the market that determines this level of stability by productivity, the standard of living, stable tax base, stability of the government and history.

Hi,

Before, you gave the example I thought of Japan in 2011. I knew someone very closed that lost everything on that day. It interesting to know that countries like Japan can have this type of affect on the “geopolitical” changes.

I did expect a conclusion but you are writing about events that occur on a daily bases around the world.

It an interesting article because I did not think that other events in the world can affect the economy.

I do not trade in the stock market, because I don’t have the funds and no training, at least not yet. This article give food for thought.

Looking at your website I see that you are a prolific writer and your subjects are diverse. I will save your website and visit at another time. Thank you

It’ s better to trust in the professionals to handle your investments if you don’t have the time but educating yourself can help you choose the best investments that the professionals recommend. Trading stock is similar to trading forex in that geopolitical events do affect the whole stock market. However, the difference is that individual stocks tend to move on according their own individual reported news.

Very interesting topic. The page is well laid out . The material is presented well, however, I was looking for a conclusion that would tell the reader how he would use the knowledge you have described.

One minor point in the opening sentence “Recently, the threats exchanged between America and North Korea has had a huge effect “, the has should be have because the effect is caused by threats (plural).

Thanks, I’ll update it later on to supply more of a method to complement that article.

In general, one has to be aware of the present news that may affect the markets. This news is available in the form of audio and written form through news services such as Ransquawk.com

Is there a website or index which ranks or assesses the effect a geopolitical event may have on the Forex market.

There are so many events each week? it is difficult to decide which ones are significant and which ones can be almost ignored.

A fascinating article for me.

I have traded on Forex in the past and had mixed success. I found it needed dedication and focus and I had too many things distracting me.

I had a look round your other articles and there is some interesting stuff there. I certainly enjoyed reading it.

thanks for getting me interested in trading again.

There’s nothing available that does what you suggest to the degree needed. Things change so quickly; you have to be on top of them yourself through a news service such as Ransquawk. I’ll keep you posted if I find something. Forex factory calander tells you which are the important events but not how much they should move the price.